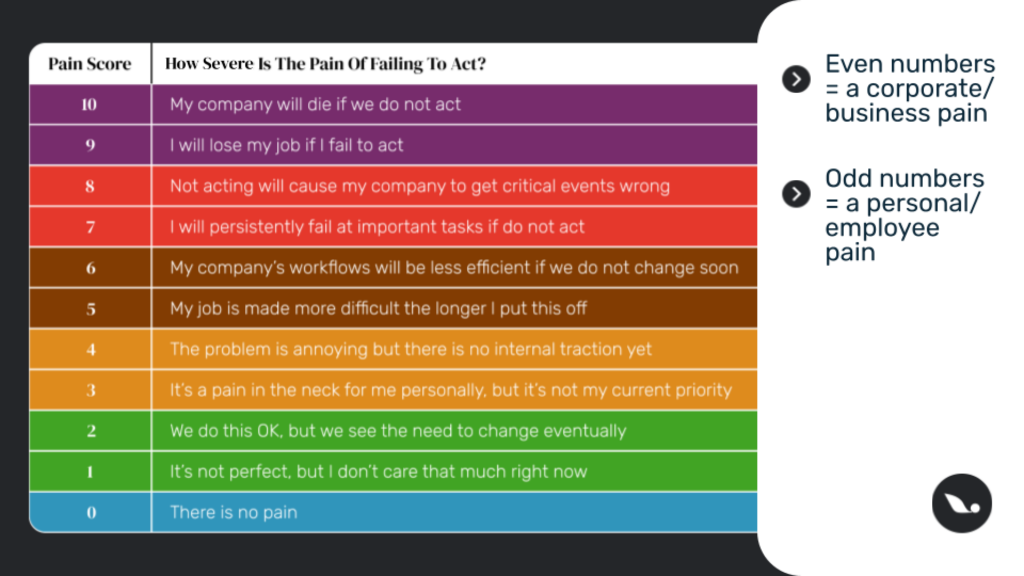

In the fast-evolving landscape of mining, development-stage mining companies often find themselves at a crossroads. The road less travelled—the one of sustainability—may seem unnecessary and filled with obstacles, but it’s a path that is increasingly required for survival and success. In a recent insightful piece by Pete Crosby of Revelsco, the concept of “pain” in business was explored, outlining how understanding and addressing pain points can lead to powerful transformations. For development-stage mining companies, failure to embrace sustainability disclosure can lead to missed opportunities, reputational damage, and financial setbacks. Let’s dive into why this is the case and how Digbee can be the solution.

The Pain of Ignoring Sustainability

- Access to Capital: One of the most immediate and critical pain points for mining companies developing a new mine is access to capital. The financial landscape has shifted dramatically, with investors increasingly favouring companies that demonstrate a commitment to Environmental, Social, and Governance (ESG) principles. Failing to prioritise sustainability not only limits access to funds but can also lead to higher costs of capital. As institutional investors and large funds tighten their criteria in an effort to raise portfolio performance, companies without a robust sustainability framework find themselves on the outside looking in.

- Social License and Regulatory Risks: The mining industry is under growing scrutiny from local stakeholders and regulators worldwide. Governments are implementing stricter environmental standards, and companies that fail to comply face significant penalties, operational delays, or even shutdowns. This, combined with ever-increasing pressure from local stakeholders, is a major pain point, especially for junior miners who may not have the resources to navigate these complex requirements. A lack of compliance not only brings immediate financial costs but also long-term reputational damage.

- Reputation and Stakeholder Trust: Reputation is everything in today’s market. For mining companies, building and maintaining trust with stakeholders, including local communities, employees, and partners, is vital. A poor sustainability record can lead to conflict with communities, negative media coverage, and loss of social license to operate. These issues not only disrupt operations but can also lead to prolonged project timelines and increased costs, severely impacting the bottom line.

- Operational Efficiency and Risk Management: Sustainability is not just about meeting external expectations; it’s also about internal optimization. Companies that ignore sustainability often miss out on opportunities to improve operational efficiency and reduce risks. Sustainable practices can lead to better resource management, reduced waste, and more resilient supply chains – leading to an improved investment proposition for investors and lenders. Without these practices, mining companies may face higher operational risks, including supply chain disruptions, environmental accidents, and inefficient resource use.

Digbee: The Antidote to the Pain

Digbee offers a tailored solution for junior mining companies to address these pain points head-on. Here’s how:

- Building Investor Confidence: Digbee provides a comprehensive and practical ESG assessment platform specifically designed for the mining industry. By leveraging Digbee’s independent assessment, developing mining companies can present a credible sustainability narrative that resonates with investors. This transparency not only enhances trust but also opens doors to new capital, helping to lower the cost of capital and secure the funding necessary for growth.

- Navigating Regulatory Landscapes: With Digbee’s expert guidance, development-stage mining companies can stay ahead of regulatory changes and ensure compliance with environmental standards. This proactive approach minimises the risk of costly penalties and project delays, ensuring smoother operations and quicker project approvals.

- Enhancing Reputation and Stakeholder Relationships: Digbee helps mining companies develop and communicate clear sustainability strategies, building stronger relationships with stakeholders. By demonstrating a commitment to responsible mining practices, companies can gain the social license to operate, foster community goodwill, and protect their reputation. This positive perception can lead to more stable operations and reduced conflict with local communities. Few mining companies have ever built a brand that consistently commands a premium valuation, but Agnico and the Lundin family of companies all command the same strengths through a commitment to a practicable and robust sustainability strategy that has led to lower risk and consistency of performance.

- Optimising Operations and Reducing Risks: Digbee’s assessments are not just about meeting investor demands; they’re also about improving internal practices. By identifying areas for improvement in resource management, waste reduction, and operational efficiency, Digbee helps mining companies become more resilient and less vulnerable to risks. This leads to more sustainable and cost-effective operations, ultimately enhancing profitability.

Example Scenario

Imagine you have a copper mining project in southern Africa. The project boasts an attractive economic feasibility study, and you are actively engaging with institutional investors and debt providers to secure financing for development. The Head of Business Development has prepared a presentation and assembled a comprehensive data room, following the usual process. However, despite these efforts, your banker is struggling to attract institutional investors to the roadshow.

The potential consequences of a poorly received financing round, or even worse, a delayed development decision due to cancelled financing, could be disastrous. During a chance conversation in a bar, a fund manager friend reveals that sustainability has become the top priority for investment committees. He emphasises that if the mining industry wants to secure investment, it must adapt by providing the investment community with credible ESG data and a clear risk mitigation strategy. With this in mind, you instruct your Business Development team to enhance the presentation and set up additional meetings.

However, you soon realise that the sustainability claims in your revised presentation are not fully substantiated, raising serious legal and reputational risks for both the company and its directors. Acknowledging these risks, you decide to postpone the fundraising efforts by two months and initiate an independent Digbee assessment. This decision not only equips you with the reliable ESG data and narrative needed to confidently engage with institutional investors, but it also leads to better internal strategic decisions. Furthermore, by taking proactive and transparent steps, the company strengthens its social license to operate, positioning itself as a leader in sustainable mining practices.

Conclusion: The Path Forward

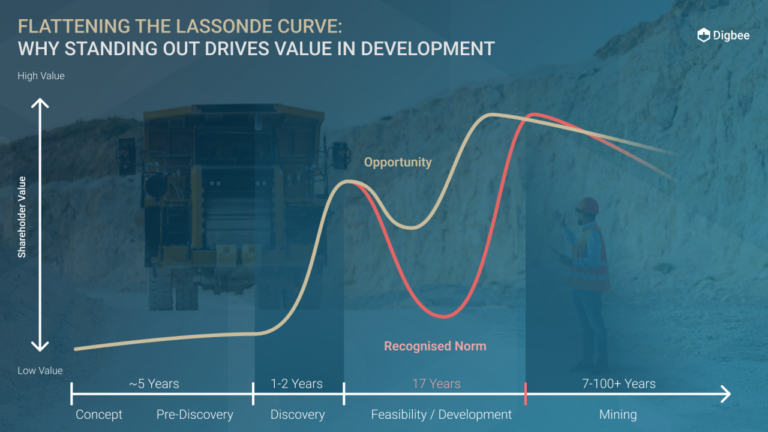

The pain of not embracing sustainability is real for mining companies looking to develop a financing solution. It affects access to capital, regulatory compliance, reputation, and operational efficiency. However, this pain is not insurmountable. By partnering with Digbee, miners can differentiate themselves and transform these challenges into opportunities for growth, resilience, and success. Embracing sustainability is no longer optional; it’s a necessity for thriving in today’s mining and financing landscape. Digbee offers the tools and expertise needed to navigate this journey, helping mining companies not only survive but also lead and differentiate themselves in the modern era of responsible mining.

As the industry evolves, those who take proactive steps to address their sustainability pain points will be the ones who come out on top. With Digbee, mining companies can confidently face the future, knowing they have a partner dedicated to their success and sustainability.