In his article, published on proactiveinvestors.co.uk, Alastair Ford details how Digbee Research is up and running, and winning banner clients

For private equity and institutional investors now prevented from international travel, there is still a way that due diligence on mining projects can be undertaken.

Digbee Research, a transformational product that was launched at the end of last year, aims to provide critical risk analysis on all aspects of a mining and development project that has information in the public domain.

It’s a simple enough proposition: Digbee’s team of accredited mining professionals, incentivised through 50% revenue share, give a critical appraisal of economic studies in key disciplines of geology, metallurgy and mine engineering.

Free of any direct financial or economic pressures or inducement from the project’s host company, the experts provide a project risk profile based on a bespoke rating system.

Mining companies, restricted by travel, are seeing multiple benefits in independent technical analysis to advance their due diligence requirements with banks, insurers and others

Jamie Strauss

Initial interest for the reports has been high, partly because the constantly changing regulatory landscape means that independent research is now extremely thin on the ground, and partly because Digbee’s roster of professionals and its network of connections is second to none.

The company has already completed 13 reports, with another 12 close to being completed after a rush of experts have cottoned on to the ability to earn long term royalties by sharing their knowledge and experience. Perhaps more impressive than the demand itself is the caliber of the customer.

“We have already been commissioned by two global fund managers” says Digbee’s founder, the veteran mining financier Jamie Strauss.

“We’ve sold reports to specialist gold funds, mining finance advisers and private equity groups. Mining companies, restricted by travel, are seeing multiple benefits in independent technical analysis to advance their due diligence requirements with banks, insurers and others.”

In some cases, effective due diligence will always require a site visit. But that’s by no means the case at every stage of the investment cycle. Geologists, based on their own experience, can quickly see from the technical reports where data may be thin or interpretations may be overly optimistic, or not supported by the data. Metallurgy techniques likewise can be assessed in an independent environment, as can engineering studies. None of this necessarily needs boots on the ground, but with due diligence requirements on the rise by a wider audience and cost pressures a constant, Digbee is beginning to build out a nice little niche into a major feature in the mining investment landscape.

“There are typically 320 new economic studies in the mining industry every year,” says Strauss, “but last year it collapsed to barely 200.”

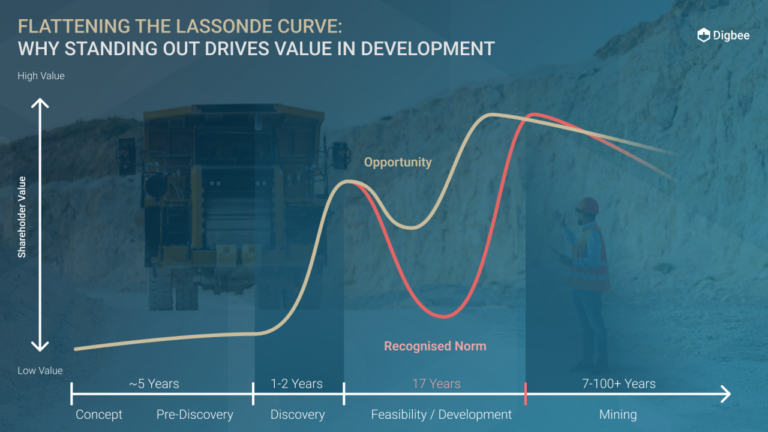

That collapse has meant that any investment group looking to invest in projects which have reached a certain level of economic modelling are faced with a quandary: either they accept that their investment universe is shrinking, or they take the initiative and try to bring projects along to a level in which they can be comfortable in deploying significant capital. One way to be confident that the risks of such a procedure are mitigated is to use Digbee research to help with decision-making.

In itself this represents a significant shift in the mining investment world, and for Digbee to be at the forefront of the change represents a real opportunity.

“To me the culture’s already changing,” says Strauss.

“It’s a huge market.”

The subtlety here is that it’s not valuation that Digbee research focuses on. And this is quite deliberate.

“People are looking to mitigate risk and increase confidence and improve execution” says Strauss.

“The valuation is irrelevant if you don’t have confidence in the underlying data”

That’s why Digbee is beginning to find a new audience amongst mining project insurance brokers. Under huge cost pressure even before the current global crises and forced to improve their analysis ahead of presenting to underwriters, they don’t always need to go to site themselves but need a comprehensive understanding of the nature of the risks involved.

But insurance is just one growth area as Digbee continues to build out. Expect more offerings in the ESG space in due course.

In the meantime, for those interested in a taste of Digbee due diligence from the safety and self-isolated position of their own laptop, there’s research publicly available on Solgold’s Alpala project, on Rubicon’s Phoenix project, Bluestone’s Cerro Blanco project, Ivanhoe’s Kamoa-Kakula project and on Integra’s DeLamar project, amongst others, on the Digbee website.