There are few sectors that touch as many practicable ESG topics on a day-to-day basis as mining. Mining has been demonised for many reasons – its legacy of poor governance, the slow change in Board diversity, direct and indirect emissions from mining activities, the clearing of nature to facilitate extraction, impacted local communities and, all of this, often in politically and environmentally sensitive areas. If a researcher were to undertake a thesis on practicable ESG, the mining sector would be the place to start.

The demonisation of the sector may not be entirely fair. Major producer miners have been at the forefront of sustainability for two decades. Yes, there have been a number of well publicised mining disasters, but despite this, the statistics across the board have improved markedly. Encouragingly, the access to project debt to develop new mines has been linked to ESG topics since the introduction of Equator Principles in 2003.

However, this hides both the lack of understanding and subsequent disclosure of ESG amongst the 2,500 listed smaller companies. These are companies who generally highlight their commitment to ESG but completely fail to follow this through with any form of relevant data. Corporate presentations from junior miners tend to contain the usual page of ESG, outlining their commitment, promoting close relations with local communities, a photo of beautiful green fields and abundant water but with limited or no trackable data to support this or the full spectrum of ESG topics. Just this morning I was reviewing a presentation from a junior miner which proudly stated on page one that they are “a sustainable gold producer” but then failed to make any effort to even justify this or even mention ESG/sustainability throughout the rest of the presentation. This is why the sector is often accused of greenwashing.

The mining sector has been incorporating ESG topics into its day-to-day social licence for the last two decades and now has the opportunity to earn its credibility back and transform its terrible legacy through the use of ESG structures. To do this, the sector needs to understand the full spectrum of ESG, employ a means of communication to help investors and other stakeholders, raise confidence as well as transparently embrace this future to reap the benefits.

These presentations are typically developed for the financial community. In a recent poll of fund managers, 50% stated that ESG had become more embedded within the investment process over the last 6 months, with over 46% stating that non-climate related topics were increasing in importance.

Non-climate topics are very closely related to junior miners as they emit a relatively limited amount of CO2 emissions. The introduction of TNFD (Taskforce on Nature-related Financial Disclosures) in H2 2023 has the potential to significantly impact the sector given the nature of developing mines as it enables companies and financial institutions to integrate nature into the decision-making process.

There is early evidence emerging, supported by this poll, that the ESG debate is bifurcating – moving away from Government driven actions and more into the process of investment as the evidence begins to show that companies which embrace ESG typically have a better management structure and a lower risk profile.

The deepening embracement of ESG within the investment process is perhaps more nuanced. Not only is there an increased awareness of mis-selling “green funds” but the fact that $20+trln will be inherited by Gen Y and Z profiles over the next 30 years, extensive research overwhelmingly indicates that sustainability issues are high priority for these groups when it comes to investment. Ignore this and the investment banks risk customer retention.

ESG is considered differently by different stakeholders, therefore there is no right or wrong. However, most people can agree that companies should be encouraged to govern in a way that reduces CO2 emissions, minimises environmental impact and improves the lives of their local communities.

The default result to-date has been to encourage companies to disclose to one or more of a myriad of Global Standards. Some mid-cap mining companies should be rewarded for doing what they believe is the right thing and publishing reams of complex, technical data to meet their compliance obligations, however this data can be difficult to interpret, interrogate and compare, thus not doing a great deal to help most interested parties. While certain emission data is helpful, the bulk of the data largely fails the intent of demonstrating positive action across the 30+ topics of ESG.

To achieve success for all stakeholders we need to ensure companies understand the true benefits and not be blinded by the commentary of compliance. ESG structures need to reward management for achieving positive action, they need to inspire workforces to embrace the culture of a sustainable operation and they need to provide Boards of Directors with a practicable means to incorporate ESG throughout the strategy and decision-making process.

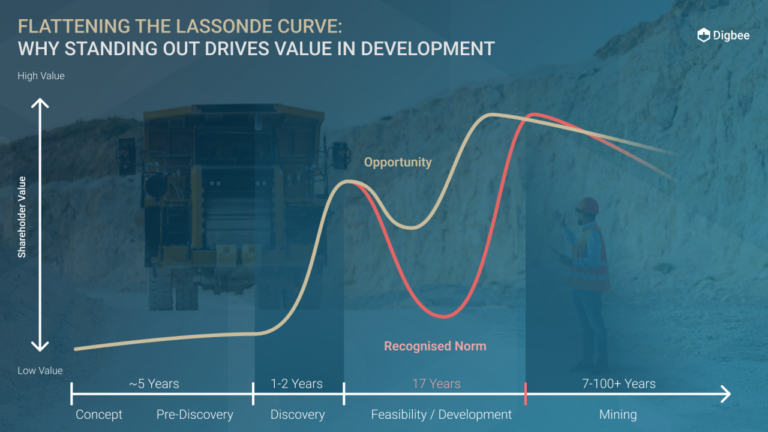

Not all ESG actions will provide a financial benefit – we need to be honest about this – but many actions, particularly if followed by investment, certainly will reduce operational risk and lead to operating benefits. Furthermore, these lower risks will improve the sector’s credibility and thus ultimately raise valuations.

But it is the opportunity for the mining sector, perceived and valued as one of the worst sectors on this planet, to earn credibility through real ESG, communicated in a standardised, trackable and easy to read means. Doing so will improve confidence, provide access to new pools of capital, remove barriers to existing capital, strengthen recruitment opportunities and, over time, has the chance to improve the sector’s poor perception in society. Afterwall – our transition to a green economy is completely dependent on the mining sector.